The startup funding has been more discriminatory in the various industries, and the investors have been more cautious than before. The deal sizes and decision cycles have been decreased in several areas. Simultaneously, health technology remains a stable source of interest. Emphasis has been put on viable solutions, quantifiable contributions, and sustainability over time as opposed to imminent growth.

Demand Remains Consistent

Medical requirements do not cease in periods of economic downturns. The current issues of access, efficiency, and patient support are met by health tech products. This stability is seen by investors as stabilising. The necessity-based demand is more comfortable compared to the market guided by trends.

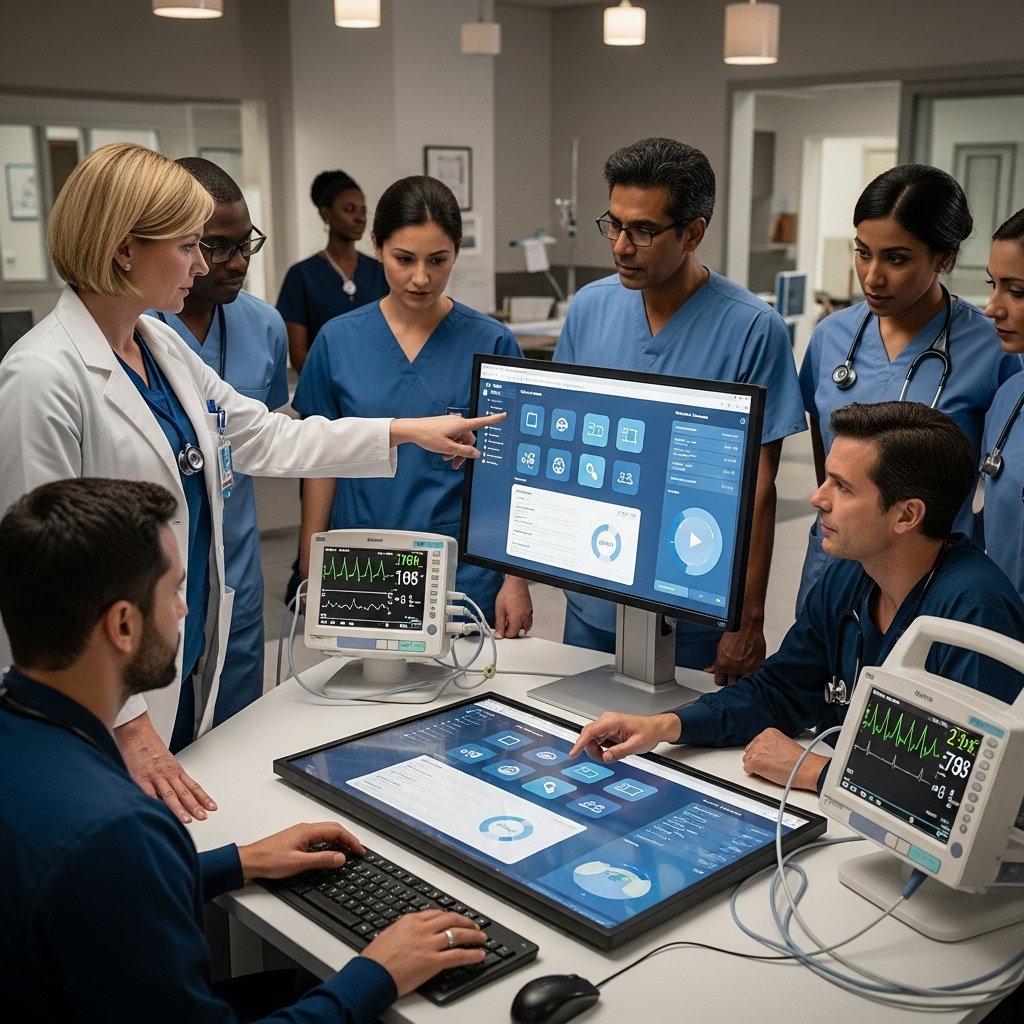

Focus on Practical Use Cases

Shareholders are focusing their attention on the companies that have evident practical applications. Such tools that enhance the diagnostics, patient monitoring, or care coordination deserve attention. Complicated concepts that have not been proven to be useful are getting minimal focus. The value is now practical rather than the projections of the ideal.

Emphasis on Cost Efficiency

The health systems are being strained to cut down on expenses and also provide good services. A technology that optimizes the workflow or lessens the workload of administration is attractive. Cost-saving solutions are perceived by investors as more resistant. Efficiency is now a major measure of evaluation.

Strong Interest in Digital Care Platforms

Telehealth and teleconsultations are also still on. These tools can be used to expand care without having to expand physical infrastructure. They have not gone rampant; hence, their introduction has stabilised, and this is a relief to investors. Regular consumption is an indicator of maturity.

Data-Driven Decision Support

Firms that provide analytics and selection tools within the discipline of health generation are nonetheless gaining traction. These platforms assist clinicians in extracting and understanding complicated data. A greater understanding is able to enrich results and design. Investors have in mind solutions that can be used to make informed choices.

Regulatory Awareness Matters More

Firms with knowledge of healthcare rules are considered to be less risky. Investors are apprehensive about compliance issues. Startups whose regulatory approaches are well-defined are unique. This is a consciousness of operative preparation and not trial.

Longer Investment Horizons

Health tech is slow to scale due to its more responsible nature. Investors are making corrections. In this space, short-term returns are not common. Patience is considered one of the virtues of the sector.

Preference for Proven Leadership

Founders who are experienced in their medical or operational areas are more likely to have confidence. Leadership that is knowledgeable of the complexity of the industry minimises uncertainty. Investors consider innovation when it comes to execution capability. Powerful teams affect the funding choices.

Integration Over Disruption

Many startups are not aimed at system replacement but at integration. The tools that can be integrated into the current healthcare settings are becoming popular. This strategy minimises user resistance. The investors consider easier adoption as a good omen.